Vehicle Setup for Fuel Tax

This article outlines the steps to properly set up Units in Encompass to ensure accurate Trip Tracking and Fuel Tax Reporting. Units must be classified as a Commercial Motor Vehicle (CMV) by selecting the appropriate Unit Type, which triggers required fields such as IFTA Base Jurisdiction, Distance Unit, Fuel Type, Axles, and Vehicle Weights. Additional Unit-Specific Settings, including IFTA Reportability and inclusion in Fleet MPG, can override Company-Level defaults in the Rule Information section. For Fuel Tax Trips generated from ELD data, the Tractor Number and Unit Code in the ELD Device List must match exactly to ensure trips are correctly created. Proper setup ensures accurate reporting and seamless integration of manual or ELD-based trip data.

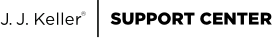

First, the Unit must be considered a Commercial Motor Vehicle, or CMV, in Encompass. This is done by the Unit Type field in the Unit file.

To classify the unit as a CMV, one of the following Unit Types must be selected:

- EH - Equipment Hauler

- RT - Road Tractor

- TK - Truck

- TK - Truck (single)

- TR - Tractor

- TT - Truck Tractor

- W - Wrecker

When one of these Unit Types is selected, a number of fields become required on the unit file. They are indicated in red.

- IFTA Base Jurisdiction - The state in which the main business location is located

- Distance Unit - Miles or Kilometers

- Fuel Type - Diesel, Gas, etc.

- # of Axles

- Unladen Weight - Weight of ONLY the vehicle

- Gross Weight - Weight of the vehicle PLUS the trailer

- Combined Gross Weight - Weight of the vehicle PLUS fully-loaded trailer, i.e., maximum gross weight

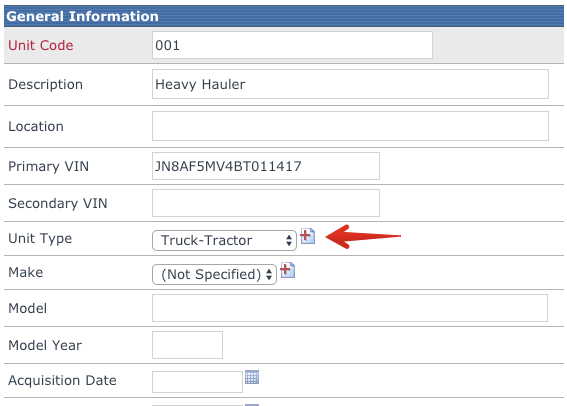

Note: Above the Save button at the bottom of the screen, there are two options for Fuel Tax Entry which applies only to users that are manually entering in their trips. The settings here apply to this vehicle only. If these settings should be applied to the entire company, please see Fuel Tax Setup.

Once these pieces of data are entered in the unit file, click Save.

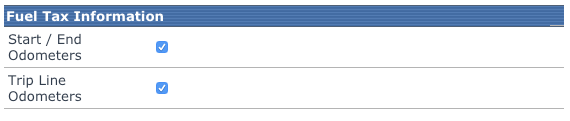

Once the vehicle information is saved, there are additional areas to look at. While in the View Unit screen, scroll down to the Rule Information section.

This section should only be edited if this particular unit operates differently than what is set in Company Level Listings. These settings here supersede the settings established at the company level.

The check boxes for Is IFTA Reportable and Is Included in Fleet MPG are the same as the ones found in Setup > Company Level Listing > Edit Rules. If the check boxes for Is IFTA Reportable and Is Included in Fleet MPG are checked at the company level, but are NOT checked at a particular unit, that unit will NOT be included in IFTA or Fleet MPG.

Fuel Tax Trips from ELD Data

If ELDs are being utilized, the tractor number AND the unit code in the ELD Device List must match exactly. If they do not, fuel tax trips may not generate from the ELD data. See ELD Device List for more about the list.