Fuel Tax - Frequently Asked Questions

There are fuel receipts missing from the Fuel Listings Report. Why?

The Fuel Listings Report requires that all fields for the fuel listing be complete before it will show up on the report. These fields are:

- Date

- Vendor Name

- City

- Cost

- Invoice Number

If any of these items are missing, it will not show up on the Fuel Listings Report.

Why can't bulk fuel be added to the fuel tax trip?

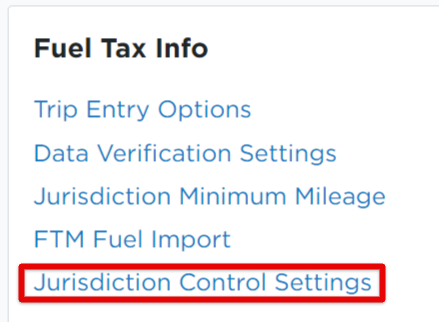

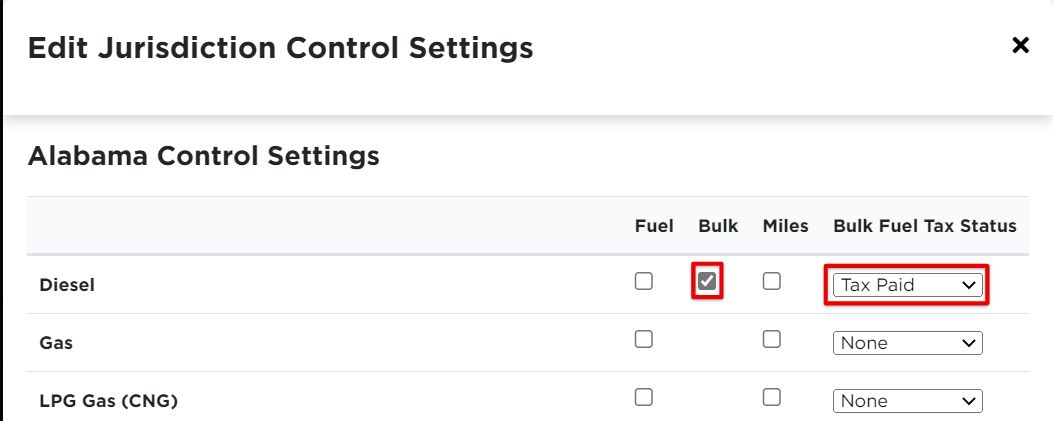

The ability to add bulk fuel is added per state by the administrator in Encompass; it is not enabled by default. To have this enabled, go to Settings > Vehicles tab > Jurisdiction Control Settings (in the Fuel Tax Info box).

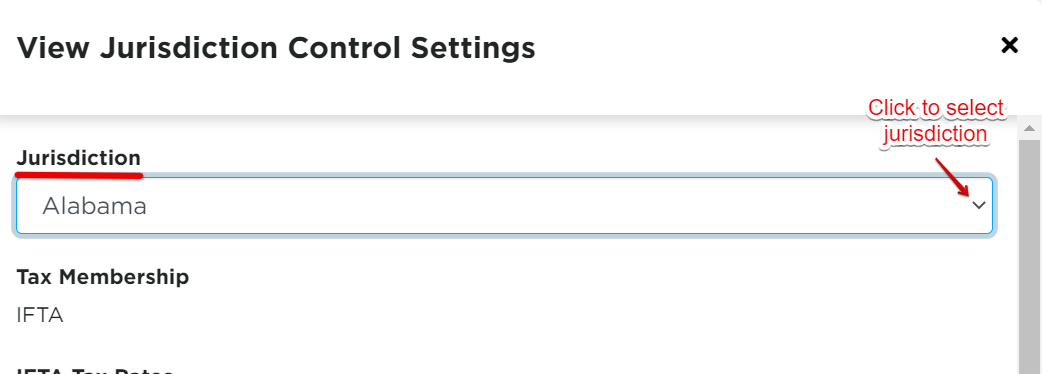

Select the jurisdiction in which the bulk fuel is retrieved and click Edit in the Listings & Bulk Fuel Tax Status area.

Select Tax Paid or Tax Not Paid from the Bulk Fuel Tax Status dropdown for the appropriate fuel type. Then, check the box for Bulk. Click Save. The user should then be able to add bulk fuel to a fuel tax trip line for the corresponding state.

There aren't enough lines to enter the entire fuel tax trip.

Click + add another under the trip line/s to populate additional lines.

What are valid and invalid gallons?

Valid gallons are gallons of fuel in which taxes have been paid. The label on the fuel purchase will likely show GR or LR (gallons or liters receipted). Invalid gallons are gallons of fuel for which taxes have not been paid. The table on the fuel will likely show GN or LN (gallons or liters not receipted).

Why don't the miles on the driver's log match the miles on the fuel tax trip?

This could happen for a couple of reasons. The fuel tax trip is handling miles for the vehicle on a given day. If there were multiple drivers in the vehicle, this could explain a discrepancy in the mileage. Additionally, the miles are calculated a little differently between the fuel tax trip and the driver's log. The log miles are determined by vehicle computer readings while the miles on the fuel tax trip are determined by GPS. The mileage between the two should be close, but they may not match.

Why are there negative odometer readings on a fuel tax trip?

The most common reason why this happens is that the ECM or the odometer on the vehicle was replaced. When the ECM or the odometer is replaced in a vehicle, the best practice is to do an Odometer Calibration within Encompass® ELD to enter the new odometer reading. This is done in Encompass® ELD by connecting to the ELD and going to Menu > System Menu > Diagnostics > Odometer Calibration. Enter in the odometer reading as it shows on the dash and press OK. See Odometer Calibration for steps to calibrate the odometer.