Add Trip Permit Listings

This article explains how to add Temporary Permits to a Fuel Tax Trip in the J. J. Keller® Encompass® system, which can allow mileage or fuel tax credits in certain jurisdictions. Users can access a Unit’s trips via Vehicles > Fuel Tax, then open the trip and select Edit Listings from the Edit screen. Required details include the Permit Date, Cost, Receipt Number, and any applicable jurisdictional Fuel or Mileage Taxes. Users can also indicate whether the permit applies to Fuel Tax, Mileage Tax, or both. Saving the entry updates the trip record for accurate tax reporting.

Temporary permits that have been purchased can be added to the trip. Some jurisdictions allow you to deduct the miles operated under a temporary permit or take credit for fuel purchases while operating under the permit.

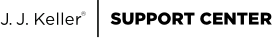

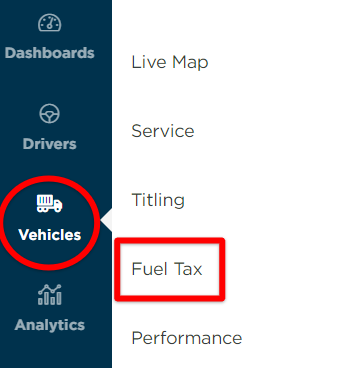

To add this to the fuel tax trip in Encompass, locate the unit by going to Vehicles > Fuel Tax. Click on the unit to open its Trips.

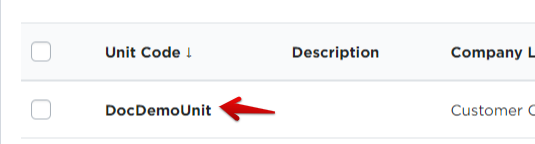

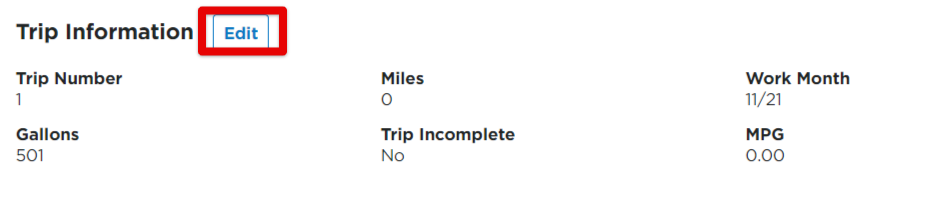

You can either click the Edit pencil when hovering on the trip line, or click into the Trip # and click Edit next to Trip Information.

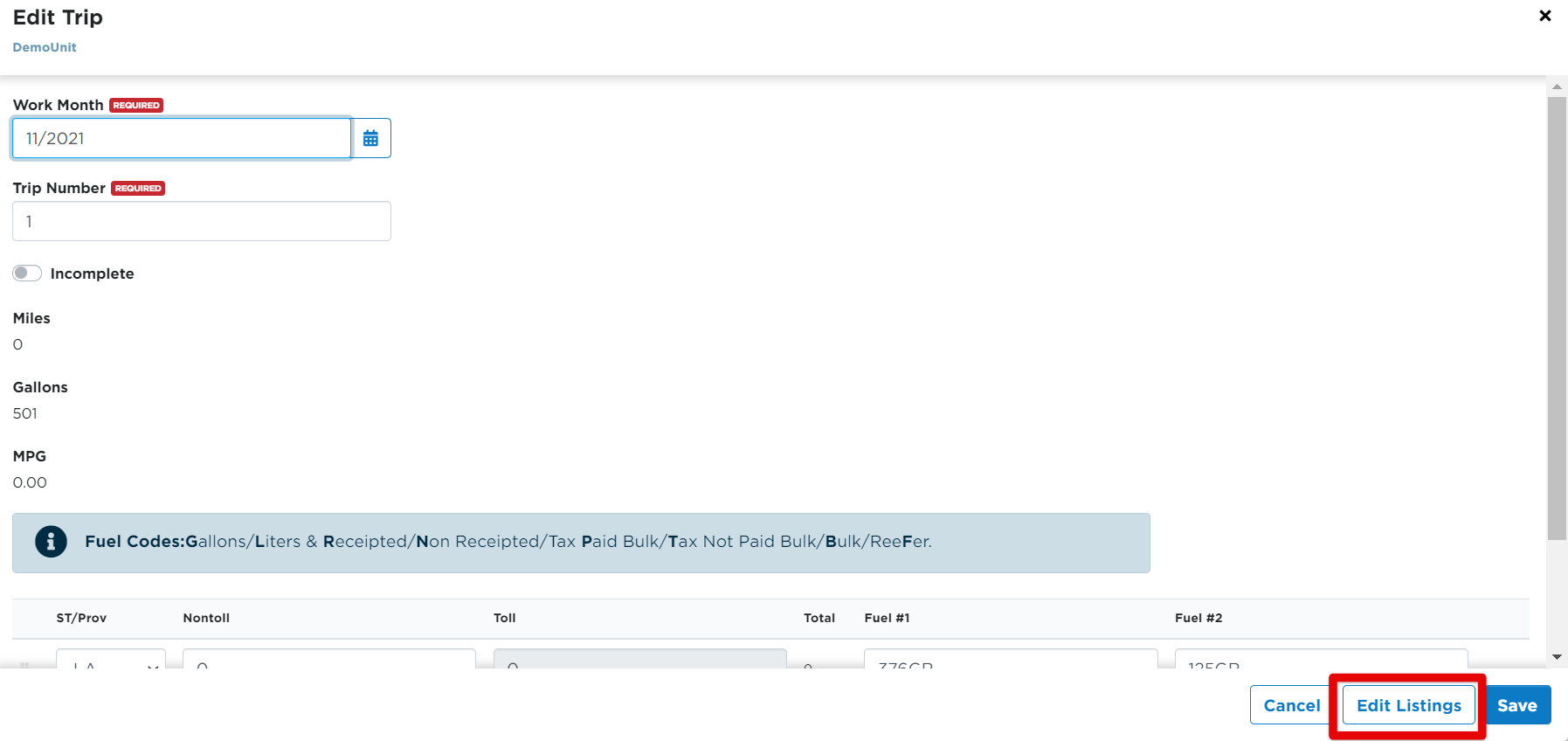

From the Edit pop-out screen, click Edit Listings near the bottom, next to Save.

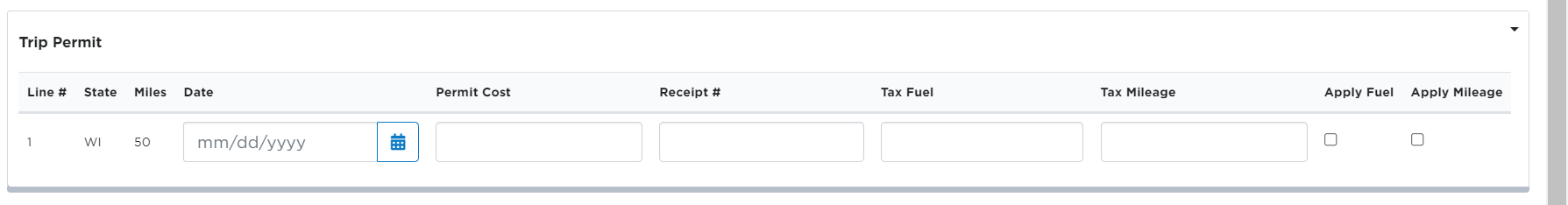

Enter the following information where applicable:

- Date - Enter the date or use the calendar next to the field to select the date

- Permit Cost - Enter the fee charged by the jurisdiction for the trip permit

- Receipt # - Enter the receipt number for the trip permit

- Tax Fuel - Applies to the jurisdictional fuel tax paid on the trip permit. If a specific tax was not paid, do not enter a value in this field

- Tax Mileage - Apples to jurisdictional mileage tax paid on the trip permit. If a specific tax was not paid, do not enter a value in this field

- Apply Fuel - Choose this if the trip permit enabled operations that are assessed a fuel tax

- Apply Mileage - Choose this if the trip permit enabled operations that are assessed a mileage tax

Click Save when all information is entered.