Add Trip Permit Listings

This article explains how to record Temporary Permits in a Fuel Tax Trip within Encompass. Many jurisdictions allow credits or deductions for Miles, Fuel Purchases, or Taxes paid under a Temporary Permit. To add this information, users navigate to the Edit Trip page and select Edit Listings, then enter details such as Date, Permit Cost, Receipt Number, and any applicable Fuel or Mileage Taxes. Once all fields are completed, selecting the appropriate apply options and clicking Save ensures the Permit is included in Compliance Reporting.

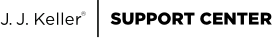

To add this to the Fuel Tax Trip in Encompass, click Edit Listings at either the top or the bottom of the Edit Trip page.

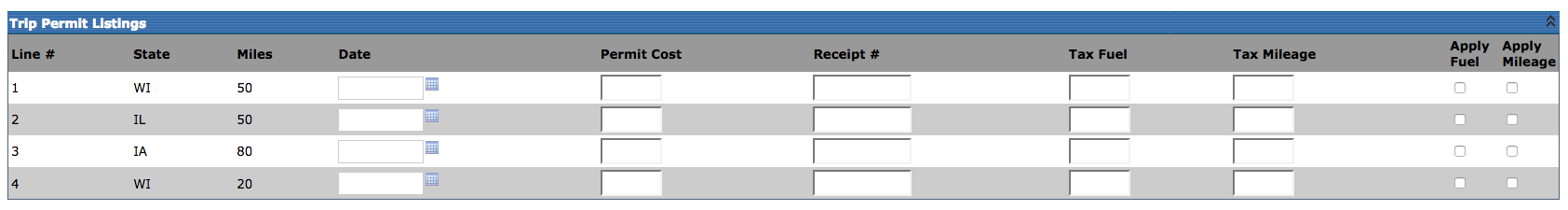

There will be a line for each trip line from the trip entry screen.

- Date - Enter the date or use the calendar next to the field to select the date

- Permit Cost - Enter the fee charged by the jurisdiction for the trip permit

- Receipt # - Enter the receipt number for the trip permit

- Tax Fuel - Applies to the jurisdictional fuel tax paid on the trip permit. If a specific tax was not paid, do not enter a value in this field

- Tax Mileage - Apples to jurisdictional mileage tax paid on the trip permit. If a specific tax was not paid, do not enter a value in this field

- Apply Fuel - Choose this if the trip permit enabled operations that are assessed a fuel tax

- Apply Mileage - Choose this if the trip permit enabled operations that are assessed a mileage tax

Click Save.