Fuel Tax Reports

This article explains how to access and use Fuel Tax Reports and Forms in Encompass by navigating to Vehicles > Reports (or Forms) and selecting the Fuel Tax category. Users can view descriptions for each Report by clicking the information icon and optionally hide previous Report Names. Available Reports include the Fuel Listing Report, IFTA Audit Report, IFTA Form and Worksheet, IRP Mileage Report, state-specific Mileage Form Worksheets (CT, KY, NM, NY, OR), State & Province Tax Report, Trip Information Report, Unit Mileage Report, Unit Tax Report, and Unit Trip Reports. Each Report serves a specific purpose, such as summarizing fuel and mileage data, calculating taxes due, or providing detailed trip-level information to support compliance with IFTA, IRP, and state tax regulations. These tools help fleet managers and compliance staff maintain accurate tax records and meet reporting requirements efficiently.

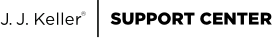

Fuel Tax reports and forms can be accessed by going to Vehicles > Reports (or Forms)

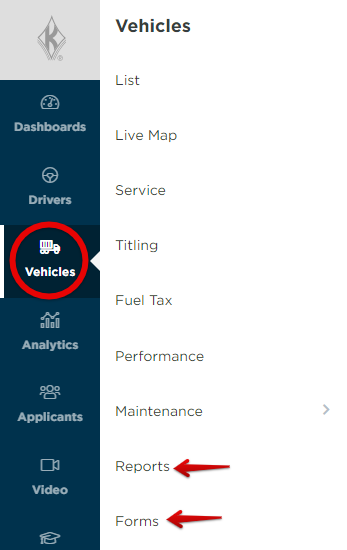

Definitions for each report listed are available to learn more about the report. Click the (i) button next to the report title to view the description.

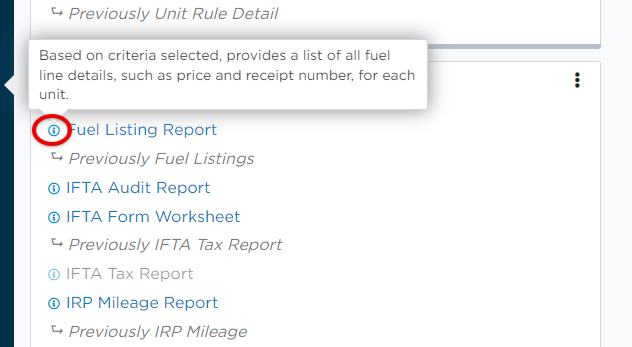

Some reports may have been named something else in the past; that information is noted under the applicable reports. To hide previous report names, turn the toggle on.

The reports specific to Fuel Tax can be found under the Fuel Tax category under the Reports and/or Forms tabs.

Report Definitions:

Fuel Listing Report

Based on criteria selected, provides a list of all fuel line details, such as price and receipt number, for each unit.

IFTA Audit Report

Provides individual trip information by vehicle for IFTA reportable vehicles.

IFTA Form

This form is used to submit IFTA. For IFTA Form guidance, visit: Encompass New UI IFTA Form and Excel Guidance

IFTA Form Worksheet (Previously called "IFTA Tax Report")

Takes miles and gallons and calculates tax (credit) due as an estimate.

IRP Mileage Report

Summarizes the distances traveled in each jurisdiction. This information is needed to complete your International Registration Plan(IRP) Schedule B.

Mileage Form Worksheet - CT

Takes mileage and gallons for the specified time criteria (last three months by default) to help estimate Connecticut mileage tax payments.

Mileage Form Worksheet - KY

Takes mileage and gallons for the specified time criteria (last three months by default) to help estimate Kentucky mileage tax payments.

Mileage Form Worksheet - NM

Takes mileage and gallons for the specified time criteria (last three months by default) to help estimate New Mexico mileage tax payments.

Mileage Form Worksheet - NY

Takes mileage and gallons for the specified time criteria (last three months by default) to help estimate New York mileage tax payments.

Mileage Form Worksheet - OR

Takes mileage and gallons for the specified time criteria (last three months by default) to help estimate Oregon mileage tax payments.

State & Province Tax Report

This report calculates the fuel and/or mileage taxes that are due for the jurisdictions according to the sort and selection options you have chosen.

Trip Information Report

Based on criteria selected, provides details of all fuel tax trips in the system.

Unit Mileage Report

Summarizes the total distance and fuel purchase information, and calculates the miles per gallon or kilometers per liter for the unit.

Unit Tax Report

Looks at each unit tax totals in terms of miles traveled, gallons (credit/debit), and state/province tax rates. It is summarized by jurisdiction, sub-totaled by each unit, and provides an overall total at the end.

- Valid gallons are gallons of fuel in which taxes have been paid.

- Invalid gallons are gallons of fuel for which taxes have not been paid.

Unit Trip Report

Provides a 'rolled-up' view of the trips in the system. For more granular data, use the Unit Trip Line Data or Unit Trip Line with Fuel Records reports.

Unit Trip Line Report

Provides data for the individual trip lines in their corresponding trips. For a higher level overview, use the Unit Trip report.

Unit Trip Line & Fuel Report

Provides fuel data for the individual trip lines for their corresponding trips. For a higher level overview, use the Unit Trip or Unit Trip Line reports.

Mileage Form

This form generates the actual mileage tax report for the jurisdictions that require one, according to the sort and selection the user has chosen. These jurisdictions are New York, New Mexico, Kentucky, and Oregon (this report includes disposed units).