Commonly Used Fuel Tax Reports and Forms

This article outlines how to access and use Fuel Tax and IFTA Reports/Forms within Encompass Vehicle Management. Users navigate to Vehicle Management > Reports & Forms, where Fuel Tax-specific Reports are listed on the right-hand side. Key reports include the Unit Tax Report, IRP Mileage Report, IFTA Tax Report, IFTA Form, IFTA Audit Report, Mileage Form, Fuel Listings, State & Province Tax Report, Trip Information Report, and Unit Mileage Report, each providing specific tax, mileage, and fuel data for Units or Jurisdictions. The article also notes that enabling Show Report Descriptions provides detailed explanations of each Report, and that pop-up blockers must be disabled for Reports to generate correctly.

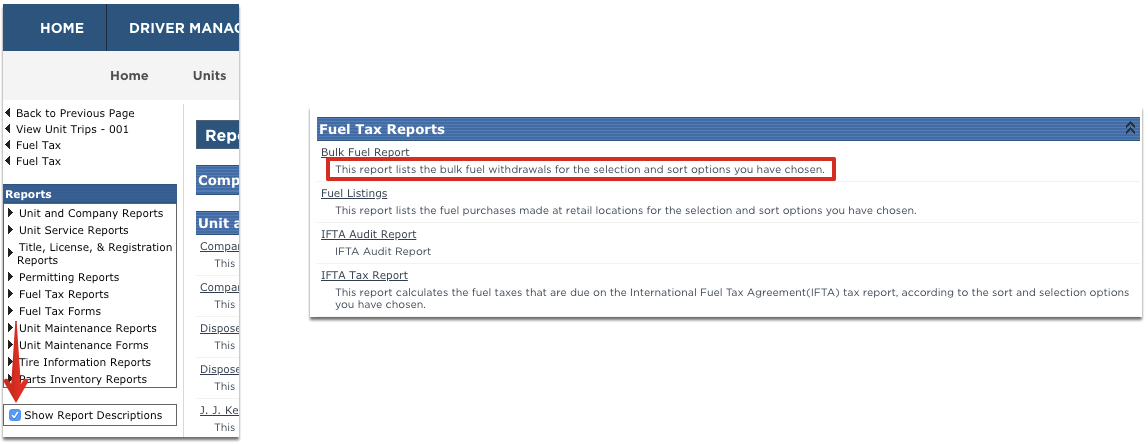

Fuel Tax and IFTA forms are found by going to Vehicle Management > Reports & Forms.

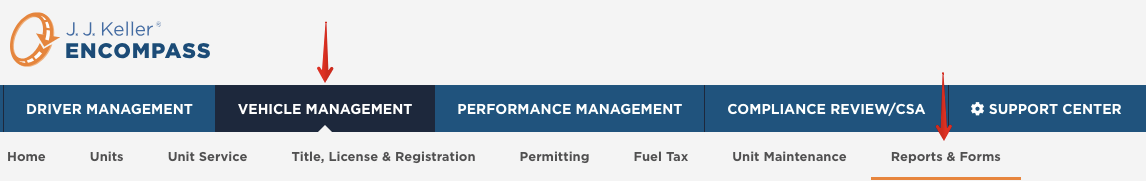

The reports and forms specific to fuel tax will be found on the right side under Fuel Tax Reports and Fuel Tax Forms.

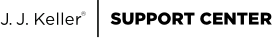

Tip: For more information as to what any of these reports provide, click Show Report Descriptions on the left hand side. This will add descriptions beneath each title of the report or form.

Unit Tax Report - calculates the fuel and/or mileage taxes that are due for the jurisdiction or jurisdictions in which the unit traveled, according to the sort and selection options the user chooses. This is used to tell what taxes are due for each unit instead of the overall company.

IRP Mileage Report - summarizes the distances traveled in each jurisdiction and calculates the percentage of operations in each jurisdiction according to the sort and selection options the user selects. This information is needed to complete the International Registration Plan (IRP) Schedule B. Usually, this report is run for the Schedule B mileage year of July 1 through June 30 of the preceding registration year (this will include disposed units).

IFTA Tax Report - calculates the fuel taxes that are due on the International Fuel Tax Agreement (IFTA) tax report, according to the sort and selection options chosen (this report includes disposed units)

IFTA Form - This form is used to submit IFTA. Either print out this report or copy the information into anew form online for the state (this report includes disposed units).

IFTA Audit Report - This report can be used when going through an IFTA Audit. The report provides the unit code, company name, trip number, start and end odometer, start and end latitudes and longitudes, End City/State, miles, and the Jurisdiction (this report includes disposed units).

Mileage Form - This form generates the actual mileage tax report for the jurisdictions that require one, according to the sort and selection the user has chosen. These jurisdictions are New York, New Mexico, Kentucky, and Oregon (this report includes disposed units).

Fuel Listings - This report lists the fuel purchases that have fuel receipts entered. If fuel is added but no receipt entered for it, it would not show in this report.

State & Province Tax Report - This report calculates the fuel and/or mileage taxes that are due for the jurisdictions according to the sort and selection options you have chosen.

Trip Information Report - This report lists each individual trip. This includes the miles in each state and fuel if entered.

Unit Mileage Report - This report summarizes the total distance and fuel purchase information, and calculates the miles per gallon for the unit. Summary information is also listed for reporting levels and the company.

Note: If a report doesn't generate, this may be an indicator that a pop-up blocker is enabled. When running reports, make sure pop-up blockers are disabled for Encompass.