Filing your Form 2290

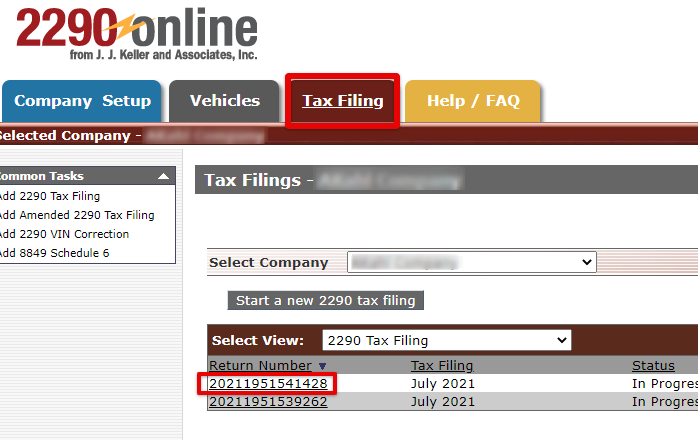

Select the Tax Filing tab at the top.

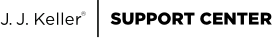

Note: Vehicles must be entered in your 2290 Online account prior to completing your tax filing. If vehicles have not been added, the message below will be displayed when viewing the Tax Filing tab. See Adding Vehicles.

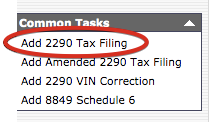

From the Common Tasks menu on the left, select Add 2290 Tax Filing.

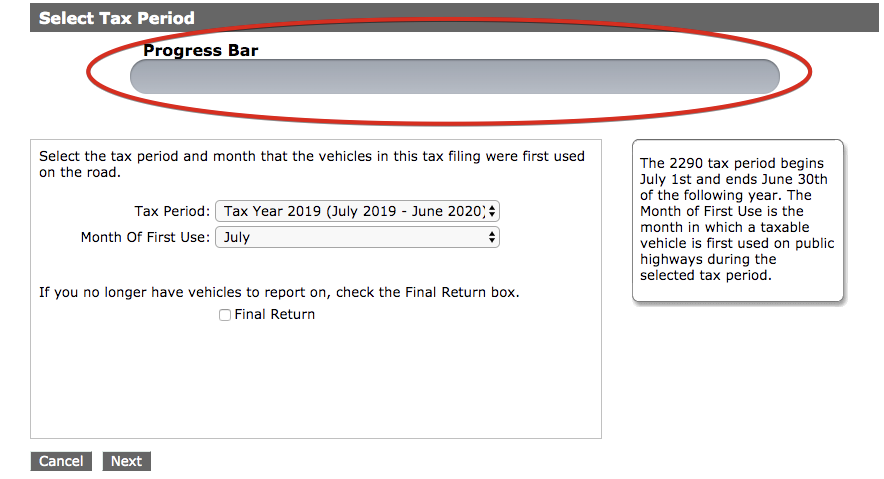

The Tax Period will be defaulted to the current tax year. The Month of First Use is the first month in that tax period that the vehicle is on the road. For example, if you are filing for the full 2020-2021 tax period, this should say July. If you acquire a new vehicle in September 2020, for example, you would need to file a Form 2290 for the 2020-2021 tax year, but the month of first use would be September. Once the appropriate selections are chosen, click Next.

Note: if your company is shutting down indefinitely and will no longer be filing Form 2290s, check the box for Final Return.

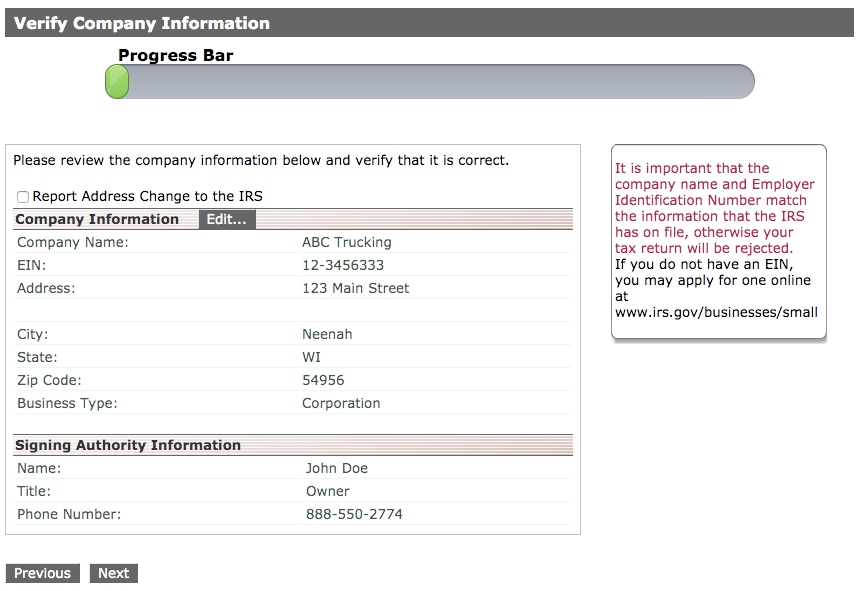

Verify that your company information is correct. If any edits need to be made, click Edit at the top of the box. Notice the progress bar at the top is beginning to fill.

Click Next.

Note: If you need to finish filing your return at a later time, your progress is automatically saved along the way. To continue filing an In Progress return, go to your Tax Filings, click the Return Number, and your return will open to the location you left off working on.

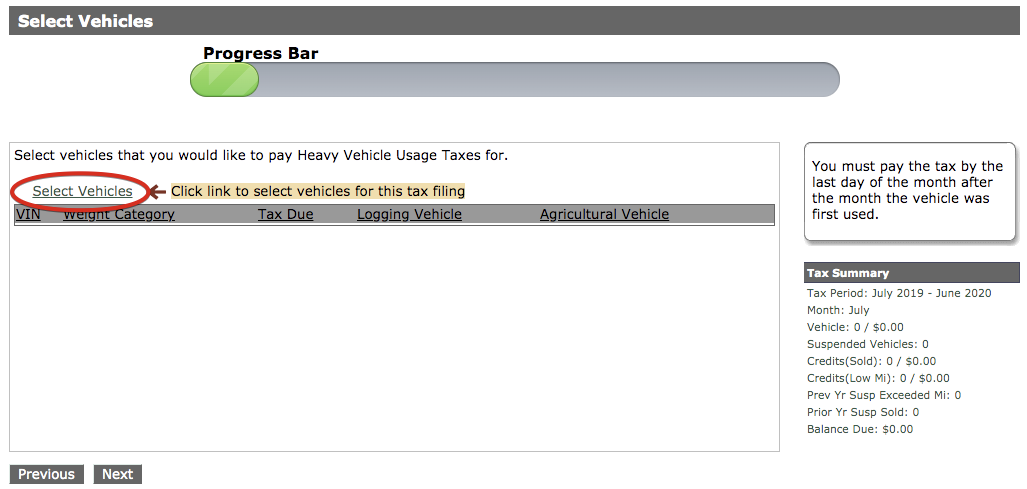

If there are vehicles that tax must be paid for, click Select Vehicles

Note: If the vehicles you are filing for must be filed for, but are exempt from tax, do not add those vehicles here. This area is to add vehicles you need to pay the tax for.

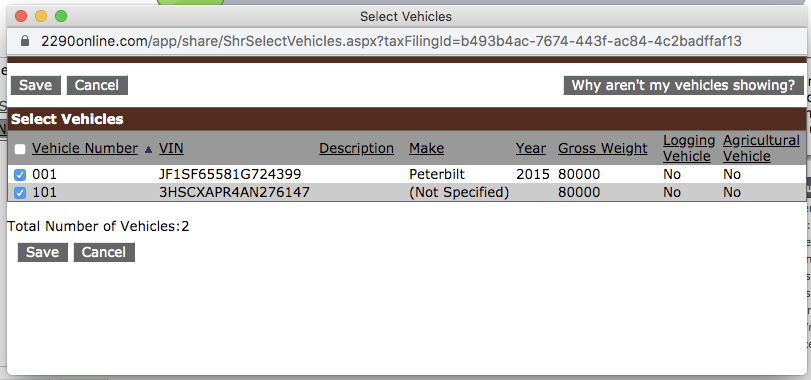

An additional window will display (ensure any pop-up blockers have been disabled). Select the vehicles you need to pay the Heavy Vehicle Usage Taxes for. Click Save.

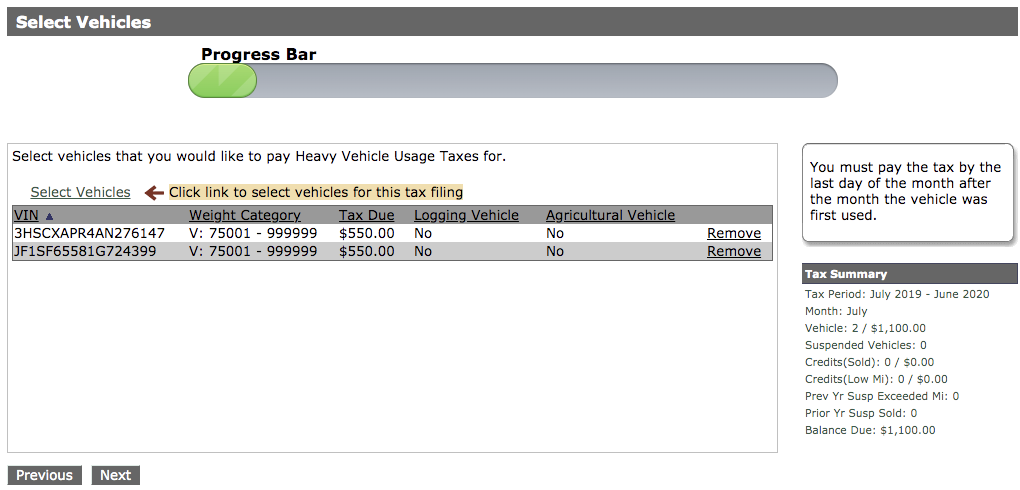

Once the vehicles are displayed on the Select Vehicles screen, click Next.

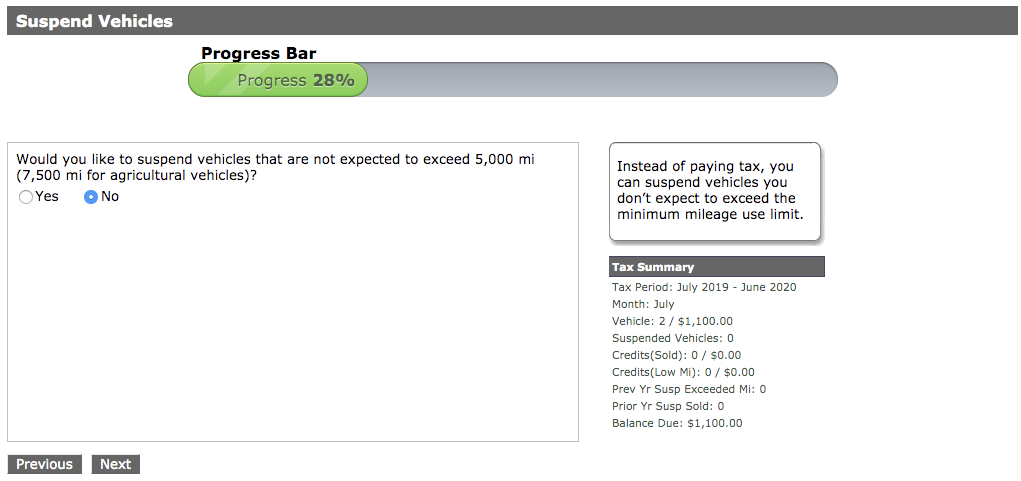

If there are vehicles that you need to file for, but are not required to have taxes paid on them due to the distance they travel, select Yes on the Suspend Vehicles screen, otherwise, select No.

- If you select Yes, you'll be directed to a page similar to the prior screen to select the vehicles that need to be suspended. Click Select Vehicles and check the vehicles that need to be suspended.

- If you select No, you'll be directed to the next step in the filing.

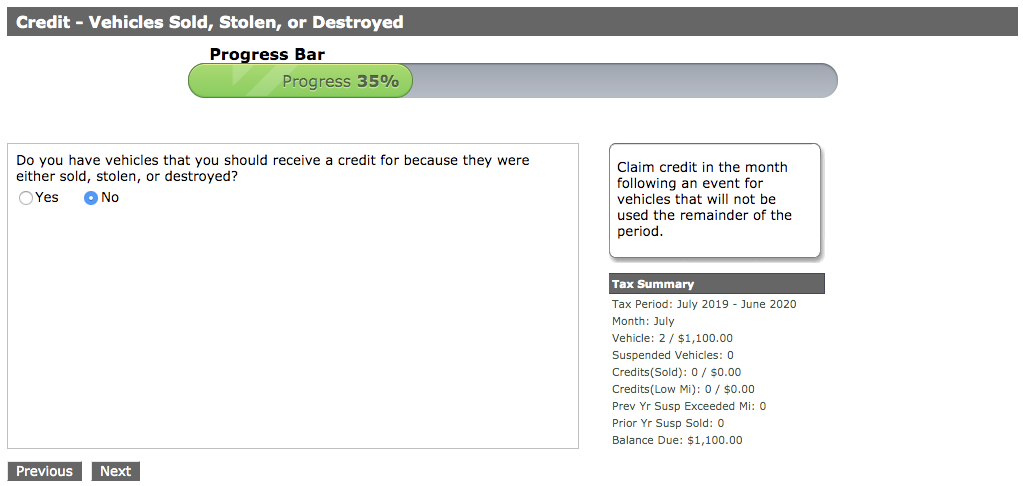

If there were vehicles in which the tax was paid already for the current tax period, however, the vehicle is no longer going to be used for the remainder of the tax period, and therefore, you are entitled to a credit, they can be added to this Form 2290.

Note: The amount of credit received cannot exceed the amount of tax that must be paid. For example, if you are paying tax for 1 vehicle totaling $550.00 and claiming credit for two vehicles totaling $1,100.00, that nets a refund of $550.00. One vehicle can be claimed for credit on this filing to make the balance due for taxes $0.00 and then an additional credit form can be filed to received the credit for the 2nd vehicle).

- If you select Yes, you'll be directed to a page similar to the prior screen to select the vehicles that need to be claimed for credit. Click Select Vehicles and check the vehicles that you'd like to receive credit for.

- If you select No, you'll be directed to the next step in the filing.

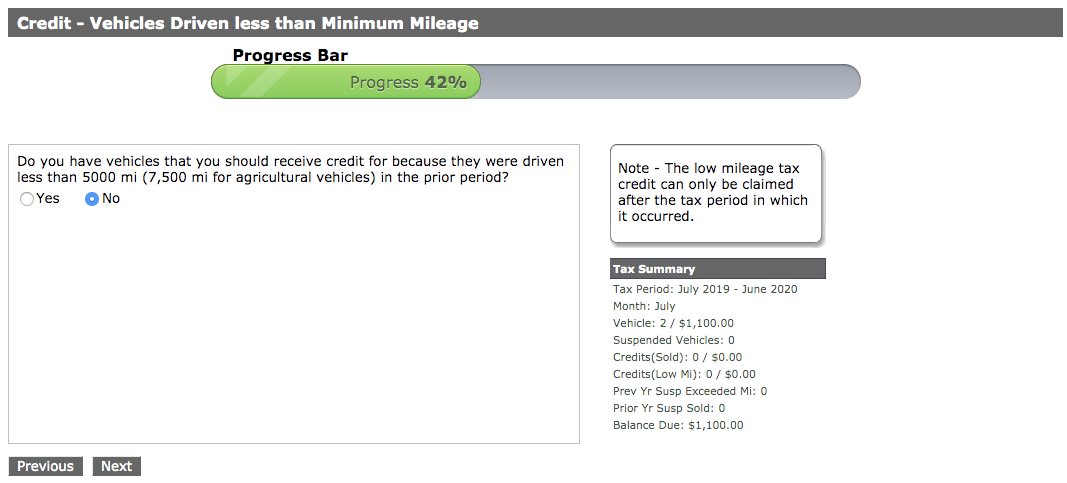

If there are vehicles that you paid the heavy vehicle usage tax for in the prior tax period but the vehicle didn't travel more than 5,000 miles (or 7,000 miles for agricultural vehicles) and you are therefore entitled to a credit, they can be added to this Form 2290.

Note: The amount of credit received cannot exceed the amount of tax that must be paid. For example, if you are paying tax for 1 vehicle totaling $550.00 and claiming credit for two vehicles totaling $1,100.00, that nets a refund of $550.00. One vehicle can be claimed for credit on this filing to make the balance due for taxes $0.00 and then an additional credit form can be filed to received the credit for the 2nd vehicle).

- If you select Yes, you'll be directed to a select the vehicles that need to be claimed for credit. Click Select Vehicles and check the vehicles that you'd like to receive credit for.

- If you select No, you'll be directed to the next step in the filing.

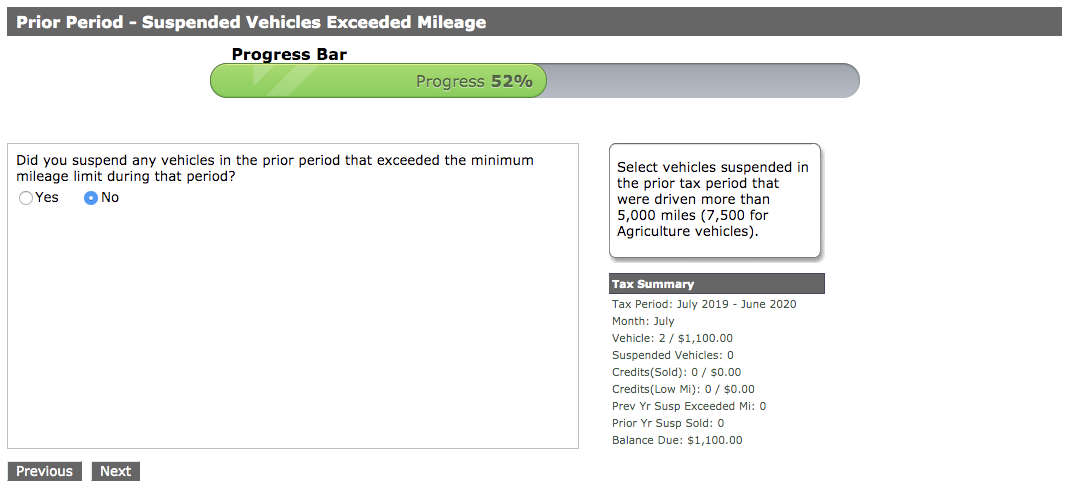

If there are vehicles that you did not pay the heavy vehicle usage tax for in the prior tax period, but the vehicle ended up exceeding the minimum mileage requirement and you therefore need to pay the tax for that vehicle for the prior period, they can be added to this Form 2290.

- If you select Yes, you'll be directed to a select the vehicles that need to have the tax paid for. Click Select Vehicles and check the vehicles that you'd like to pay tax for.

- If you select No, you'll be directed to the next step in the filing.

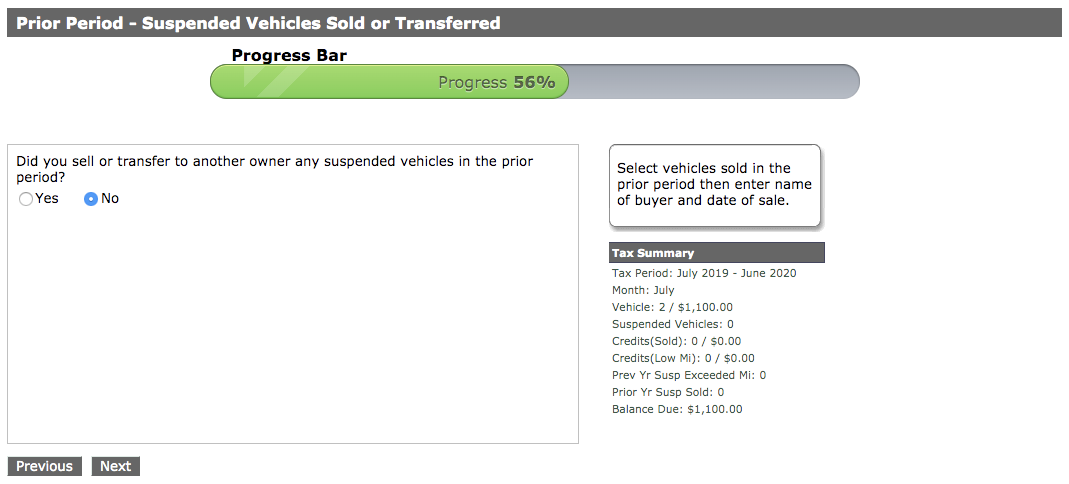

If there are vehicles that you had suspended in the prior tax period, but the vehicle was sold or transferred to another owner, this can be indicated on this Form 2290.

- If you select Yes, you'll be directed to a select the vehicles. Click Select Vehicles and check the vehicles that you'd like to pay tax for.

- If you select No, you'll be directed to the next step in the filing.

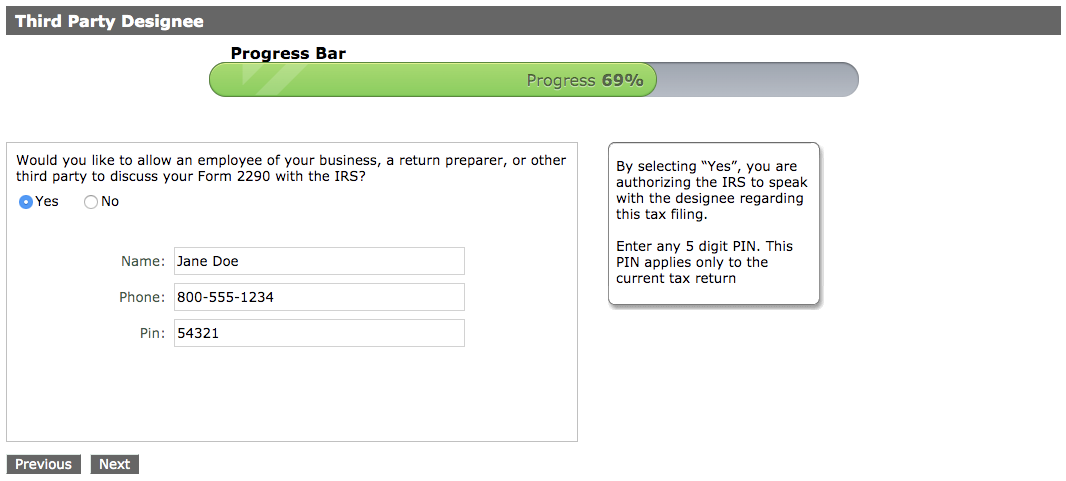

If there is an additional person, other than yourself, that should be authorized to speak with the IRS about this Form 2290, select Yes and enter in their information. The PIN is any 5 digit number of their choosing that they use to authorize themselves with the IRS.

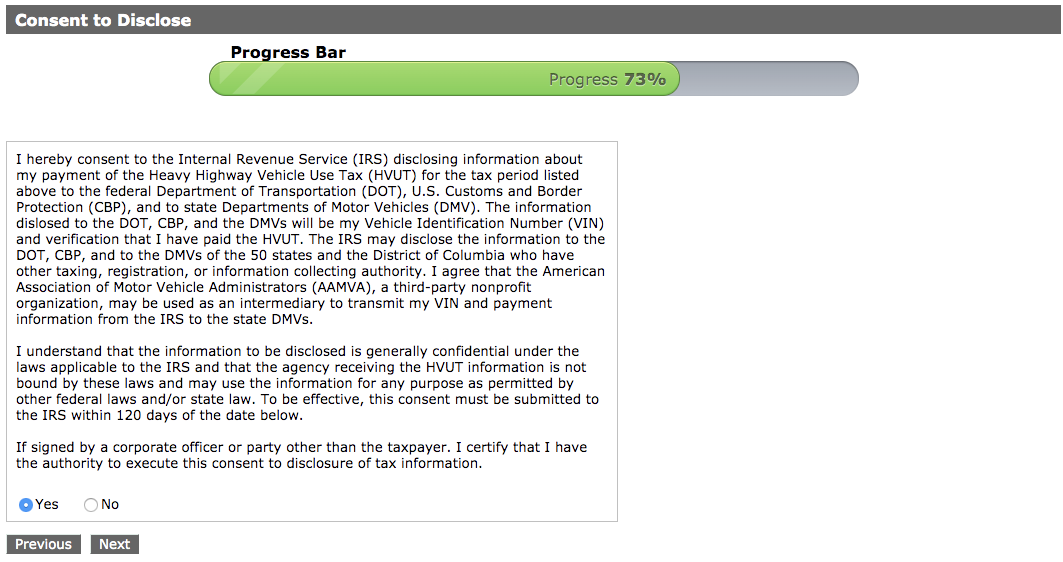

The Consent to Disclose allows for the IRS to speak with additional agencies regarding your Form 2290. Neither selection impacts the actual filing of the form, but it can make working with other government agencies simpler. If you do not want the IRS to speak with anyone else regarding your Form 2290, select No.

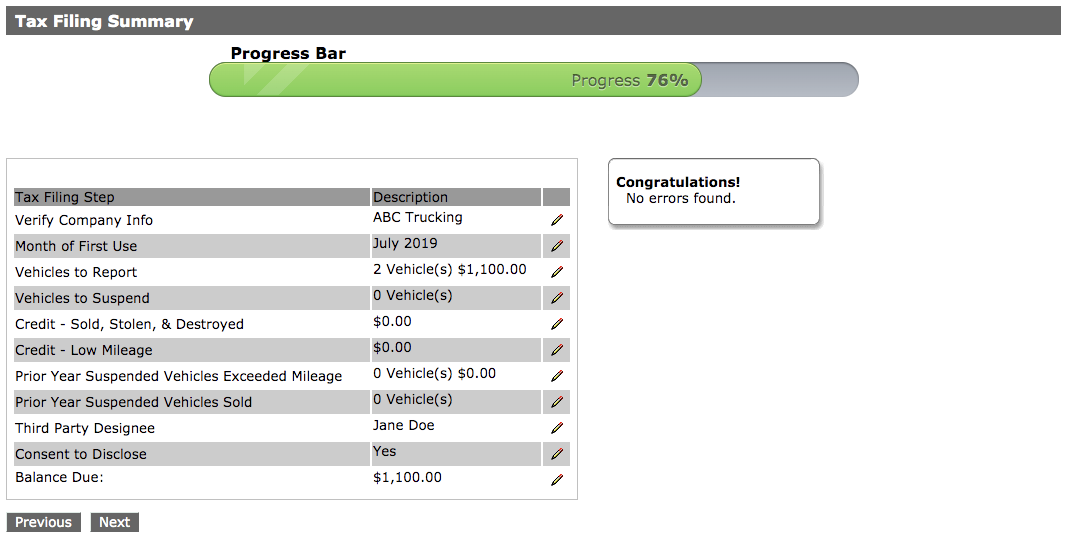

Review the Tax Filing Summary and ensure all information is correct.

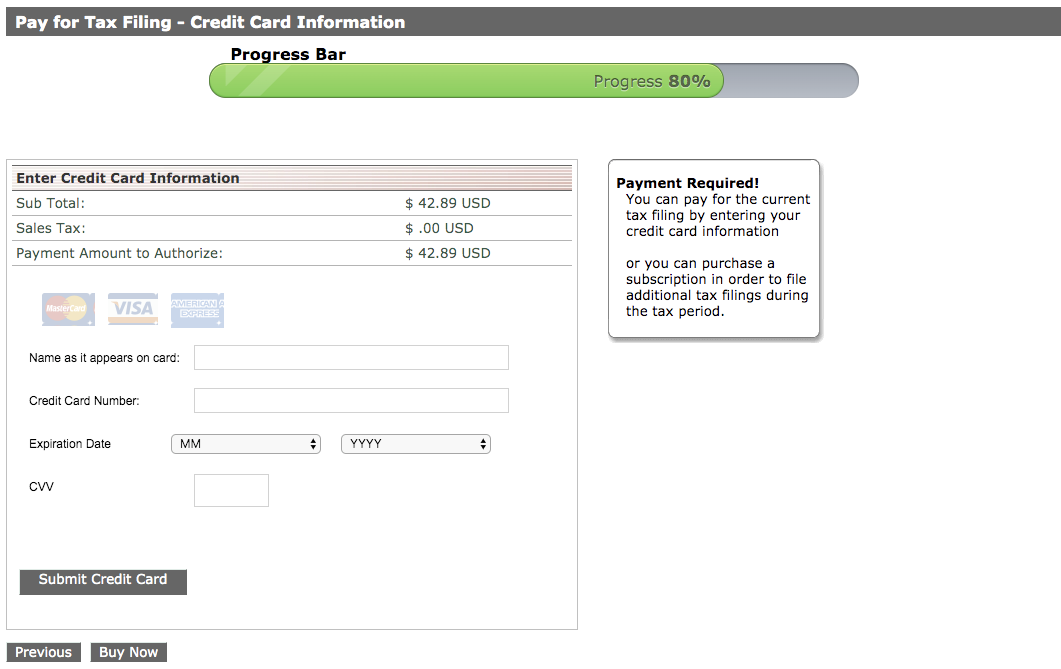

Enter your credit card information to pay for processing of your filing. Once complete, click Buy Now.

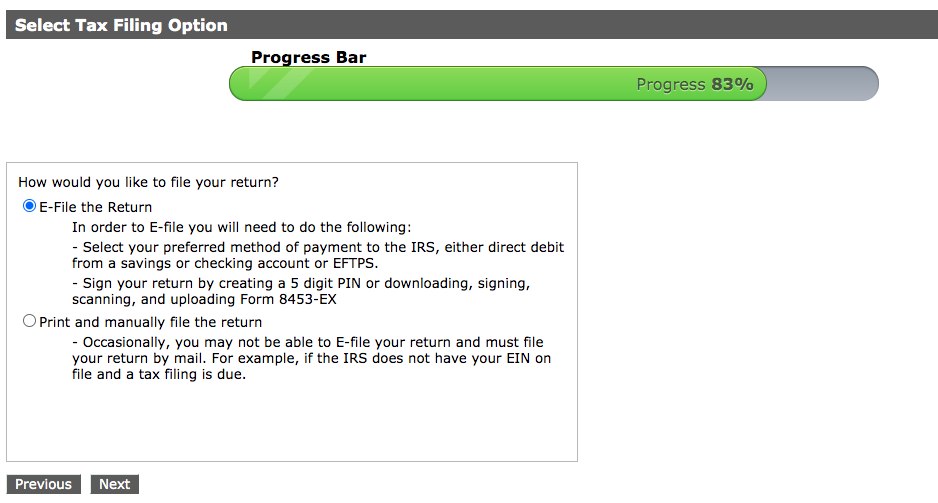

Select how you'd like to file your return. For quick processing of your filing, select E-File the Return. Click Next.

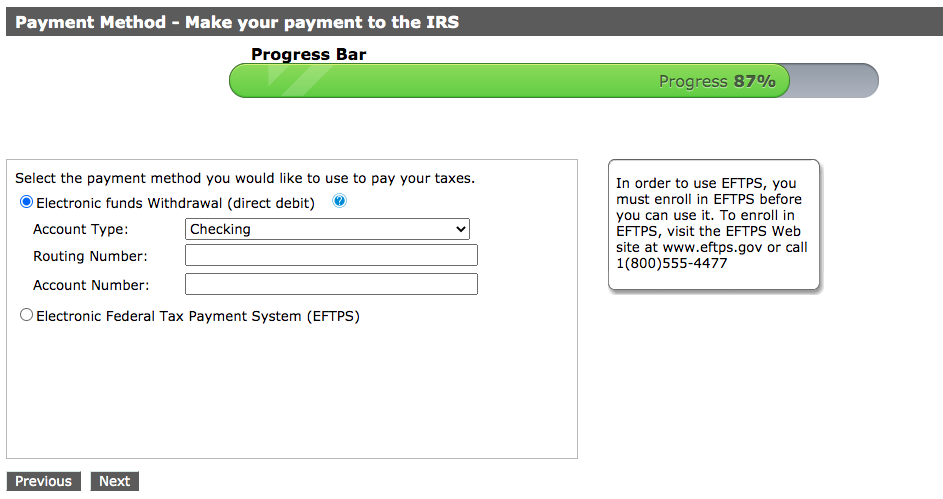

Select how you'd like to pay the Heavy Vehicle Usage Tax. Select Electronic funds Withdrawal (direct debit) to have it deducted from a checking/savings account using an account and routing number. Select Electronic Federal Tax Payment System (EFTPS) if you have an account set up through the IRS to pay the tax. If you have $0 due for the tax due to suspending vehicles, select EFTPS. Click Next.

If EFTPS is selected for the tax payment method, an email will be sent to you with a link to pay any taxes due.

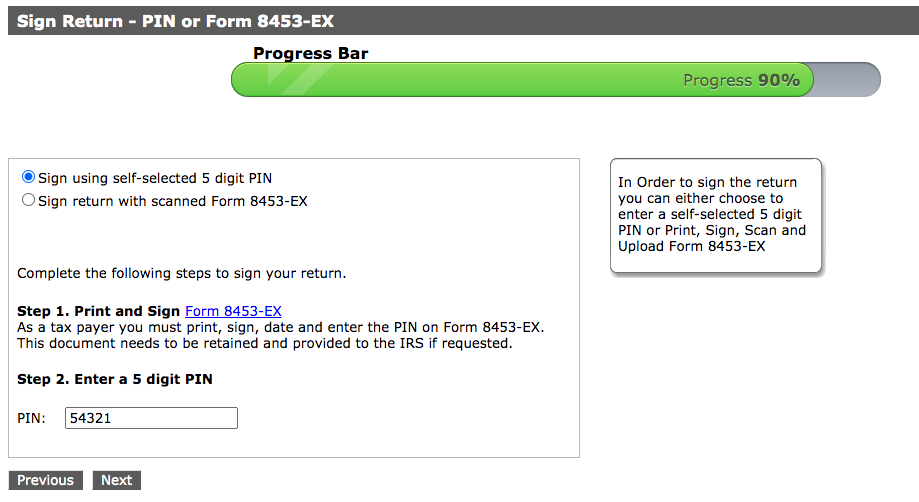

Sign your filing using a self-selected 5 digit pin number or print the 8453-EX form, sign it, and upload it. The simplest way is to select a 5 digit pin. A 5 digit pin is any 5 numbers of your choosing and cannot being with a 0. This number serves as your signature on the filing. Click Next.

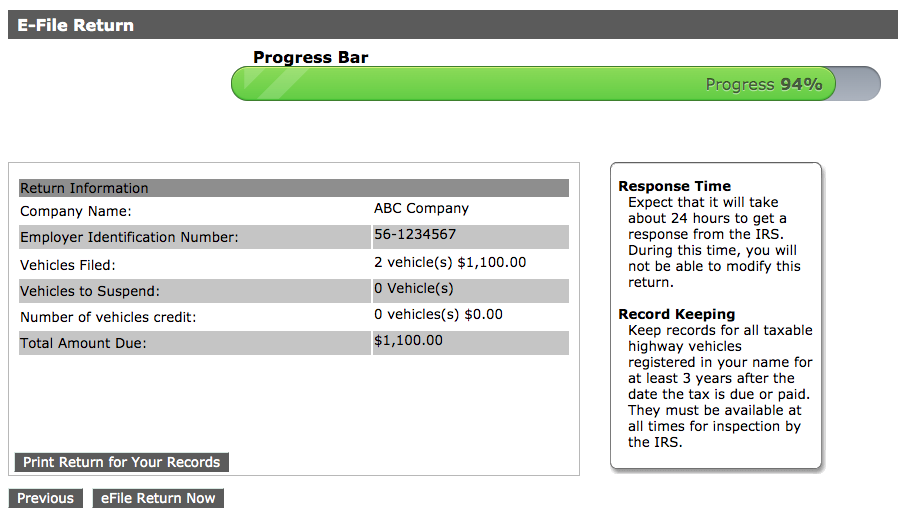

If you'd like, you can print the filing here for your records. The e-file will be available for print at anytime once the filing is processed by the IRS. Click eFile Return Now to submit the filing.

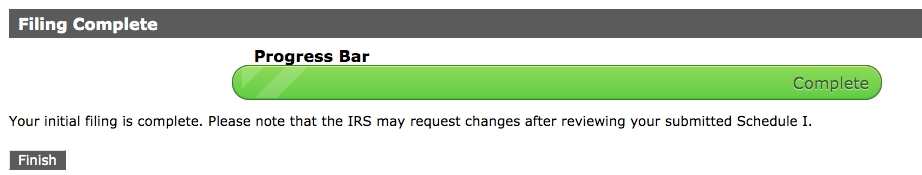

A completed message will be displayed. Click Finish.